TechNode | What can Europe learn from China’s live e-commerce boom?

Brands venturing into livestreaming at home need to be aware of cultural differences.

by Claudia Vernotti, Director of ChinaEU

China’s annual Singles Day online shopping festival has yet to officially kick off on Nov. 11, but its “pre-sales” events already hint that the hot sales trend will again be live e-commerce.

“Lipstick King” Li Jiaqi generated an estimated gross merchandise value (GMV) of RMB 726 million ($113.5 million, or EUR 97 million) for L’Oréal during a Taobao livestreaming event on Oct. 20, according to Ashley Dudarenok, founder of China trends watching company ChoZan.

European brands L’Oréal and Guerlain jumped on the country’s live e-commerce bandwagon early on back in 2016, hiring Chinese influencers to promote their cosmetics to Chinese viewers. Now, fueled by the pandemic, European companies are embracing livestreaming as well as promotional techniques from China as they target online European shoppers. They still have a lot to learn.

Since its first appearance, live e-commerce has exploded in China and the market recorded triple-digit growth over the past three years. In China, the online shopping format is expected to be worth RMB 4.9 trillion in 2023, according to the China’s 2021 Live-Streaming E-Commerce Industry report released by market research firm iResearch on Oct. 27.

European brands in China’s live e-commerce scene

L’Oréal and Guerlain were followed in China a few years later by Givenchy, Unilever, Procter & Gamble, Pandora, La Mer, Nestlé, and many others. Today, few big European brands with a strong Chinese presence have not run at least one live shopping show. Italian pharmaceutical skincare brand Rilastil gets 35% of its total China sales from live e-commerce.

But success in China’s competitive livestreaming market shouldn’t be taken for granted. Dudarenok explained that it is very easy to make mistakes, such as choosing the wrong KOL, the wrong platform, or the wrong presentation style.

The pandemic spurred European retailers into live e-commerce

While European players in China have long been hiring Chinese KOLs, celebrities, and their own staff to host live shows on the most popular Chinese livestreaming platforms, they were slow to transfer the format to Europe, assuming it was only fit for a Chinese audience.

A February 2021 study by Forrester and AliExpress rejected this assumption, finding 70% of 14,460 consumers surveyed in the UK, Spain, France, and Poland were interested in this new form of online shopping.

Livestreaming experiments in Europe started at the end of 2019 and increased in frequency in 2020, as the pandemic forced shops to shut down throughout the continent.

Italian apparel brand Motivi leaned into livestreaming right at the onset of the pandemic, engaging its own shop assistants to present collections and answer questions from customers in real time on its website, replicating the real shop experience.

Another example is Lancôme, which in November 2020 worked with live shopping platform Livescale to run a show with Italian influencer Chiara Ferragni.

Monki, a fast-fashion brand of the H&M Group, also launched several live broadcasts featuring experienced sellers, again with the shows accessible directly from the brand’s website.

Europe’s approach to live e-commerce

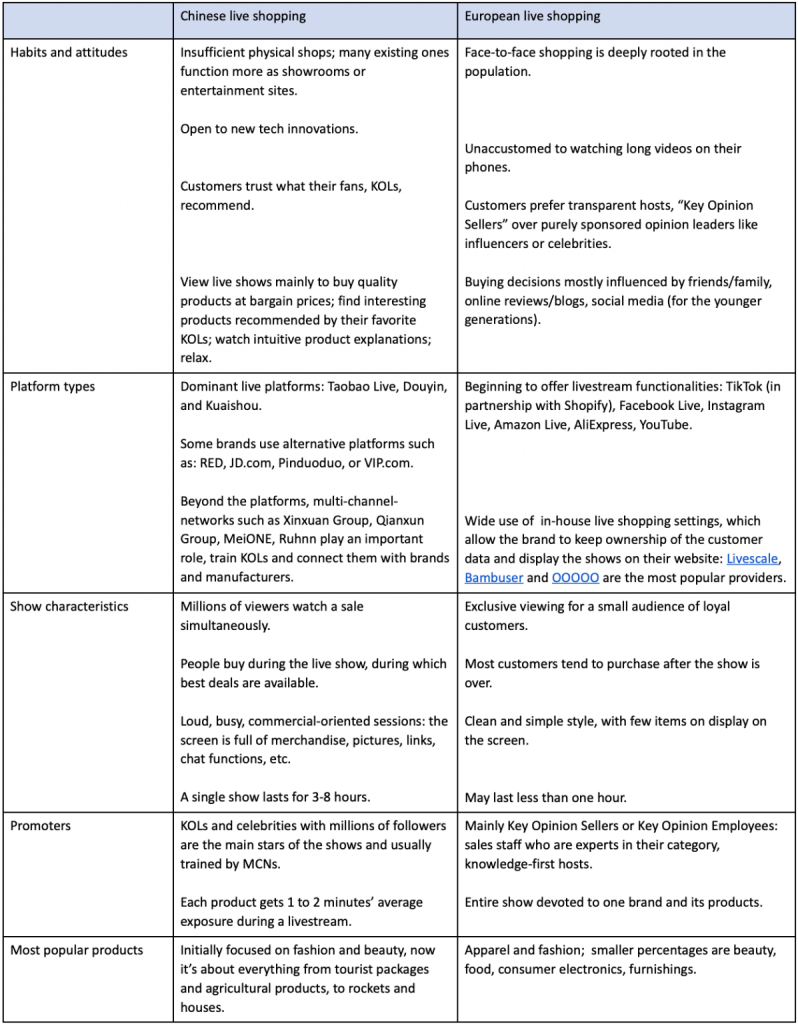

Still, when it comes to live e-commerce, China is about five years ahead of Europe. China’s experience may give us precious lessons to refer to. It took China a couple of years to transform live e-commerce into a popular format used regularly by both brands and consumers. Europe is now in the study and exploration phase, but we can predict some major differences in style and approach:

Live e-commerce in China versus Europe

Will livestreaming be big in Europe?

Years 2021 and 2022 will tell whether live e-commerce in Europe has been just a temporary pandemic-driven boom or if it is here to stay. But numbers so far point in the right direction.

In 2020, Western brands saw 15 times more engagement in live e-commerce than with traditional social media, from three to five times more sales, and a 50% increase in the number of customers, according to Madison Schill, marketing and communications director at Livescale. According to Schill, the average sales conversion rate across all clients and platforms at Livescale was 9.5% in 2020. The rate this year is running about 18% in a sign that customers are reacting well.

Live shows in Europe might remain selective experiences, highly focused on content, reflecting the philosophy of the brand and the shopping habits of local customers. Sales people will likely continue to act as the main hosts, together with micro-influencers. Chinese tech players like Xinxuan, Alibaba’s AliExpress, and ByteDance’s TikTok with expertise in training and incubating livestreamers might serve as guides for European brands desiring to improve the live selling skills of their local hosts.

If China’s growth trajectory is taken as a model, by 2024, Europe has the potential to reach around 160 million live streaming e-commerce users, of which approximately 100 million people might also make purchases while watching live streams, Leah Wang, Chief Marketing Officer of Xinxuan Group, said at the launch of the iResearch report.

In Europe, livestream shopping and e-commerce in general will probably never replace the in-store experience, but they will become part of a broader omni-channel marketing and sales strategy, in which physical shops remain at the center, sometimes serving as temporary livestreaming studios. Looking forward, we might see the expansion of live e-commerce into new verticals, maybe also into the B2B sector.

This article appeared on TechNode.